The climate crisis severely threatens economic growth in the Global South, especially in Africa, where 17 of the 20 most vulnerable countries are located.

Addressing climate risks requires the region to mobilize significant financial resources to invest in climate adaptation and development; however, African countries are facing an acute sovereign debt crisis that inhibits their ability to invest in low-carbon, sustainable economic growth.

Debt dynamics facing African nations

A new policy brief by the Debt Relief for a Green and Inclusive Recovery (DRGR) Project examines the challenging debt dynamics facing African nations and outlines several solutions that would allow African nations greater fiscal space and stability to achieve sustainable growth.

Main findings:

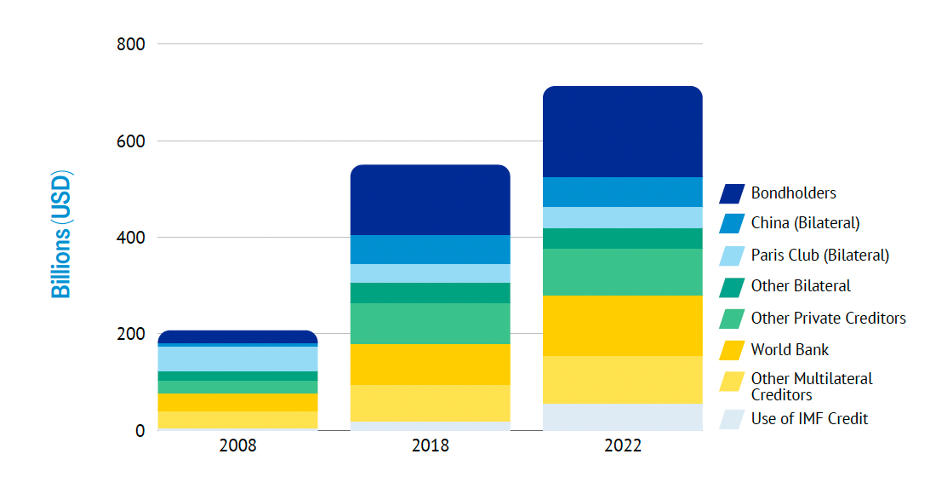

- External debt levels for African countries have increased by 240 percent from 2008-2022, with countries like Senegal, Rwanda, Mozambique and Ethiopia seeing a tenfold increase in external debt.

- Much of this debt has been borrowed on expensive terms, with over half of African nations now spending more on interest payments alone than on their public health budgets.

- Debt owed to private bondholders soared from $25 billion in 2008 to $187 billion in 2022.

Figure 2: Public external debt composition (in USD billions) by creditor type for African nations, 2008-2022

Source: Compiled by authors using World Bank (2023), DRGR Project, 2024.

Note: Includes data from 52 African nations, as per World Bank International Debt Statistics coverage. The World Bank Group comprises the International Bank for Reconstruction and Development (IBRD), International Development Association (IDA), International Finance Corporation (IFC) and Multilateral Investment Guarantee Agency (MIGA). Libya and Seychelles are not included due to a lack of data.

African countries need debt relief

- By 2028, 14 African countries are projected to breach solvency thresholds with a further 20 nations expected to exceed at least one of the solvency metrics used in the policy brief.

- Since 2020, four African nations have defaulted, and the number of regional economies effectively barred from international capital markets has grown from one in 2010, to 11 in 2024.

- At least 34 African countries will need significant debt relief to unlock the necessary funding for the United Nations 2030 Sustainable Development Goals and Paris Agreement targets, supplemented by other forms of low-cost and concessional financing.

- The case-by-case approach under the G20 Common Framework has proven lengthy and insufficient to provide the necessary debt relief for improving a country’s fiscal health. Many countries that need debt relief will not ask for it because they know they cannot expect swift and fair treatment.

- Without addressing the debt crisis, countries will be trapped in a vicious cycle of climate impacts, leading to an effective ‘default on development,’ as well as chronic underinvestment and political instability.

- To empower indebted and climate vulnerable African countries to pursue sustainable green growth pathways, a substantial infusion of low-cost financing, comprehensive debt relief and a fundamental restructuring of the international financial architecture will be necessary.

The bottom line: African leadership, particularly upcoming presidencies in the G20 and G77, will be crucial for championing reform of the debt and international financial architecture and helping to deliver sustainable and inclusive growth to the region.

About the DRGR Project:

- The mission of the DRGR Project is to utilize rigorous, policy-oriented research to advance innovative solutions to address the challenges of 21st century sovereign debt crises.

- The DRGR Project is a collaboration between the Boston University Global Development Policy Center, Heinrich-Böll-Stiftung and the Centre for Sustainable Finance at SOAS, University of London.

- Founded in 2020 during the height of the COVID-19 pandemic, the DRGR Project focuses on the linkages between sovereign debt distress and climate change, advancing pioneering proposals to unlock finance for sustainable development and to achieve shared climate and development goals.

“We are entering a decade of extreme weather events from the highest recorded temperatures and frequent devastating hurricanes to ruinous floods and aggressive fires. These climate shocks pose a risk to the economic gains made in the last decade and it is therefore urgent to finance adaptation and resilience, including through a comprehensive debt relief program,” said Bogolo Kenewendo, former Minister of Investment, Trade and Industry, Botswana, DRGR Project Co-Chair.

“We are in the worst crisis in 80 years. External public debt service ratios have reached record levels, and a growing number of countries risk defaulting not only on debt, but also on their development and climate goals. A comprehensive debt relief response that bolsters growth and safeguards the development and climate goals of these countries is urgently needed,” said Patrick Njoroge, former Governor of the Central Bank of Kenya, DRGR Project Co-Chair.

Dig deeper

- Read the policy brief.

- Read the blog summary.

- Learn more about the DRGR Project.

- Connect with members of the DRGR Project – hit reply on this email.