In October 2024, President Bola Tinubu presented the Nigeria Tax Bill 2024 to the National Assembly, aiming to overhaul the nation’s fiscal framework with a robust legal foundation for income, transaction, and instrument taxation.

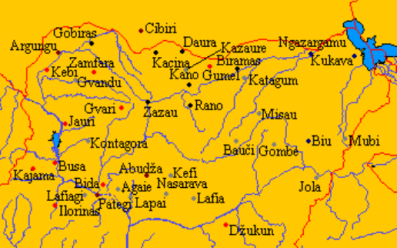

The proposed bill, titled “An Act to Repeal Certain Acts on Taxation and Consolidate the Legal Frameworks Relating to Taxation and Enact the Nigeria Tax Act to Provide for Taxation of Income, Transactions and Instruments, and for Related Matters,” has ignited significant public debate. Several governors and traditional leaders in Northern Nigeria recently voiced strong opposition, citing concerns that the bill may not favor their interests and those of other regions.

Here are the six primary provisions within the proposed legislation:

1. Increment in VAT Rates

Section 146 outlines an increase in VAT from 7.5% to 10% starting in 2025, with subsequent hikes to 12.5% in 2026-2029, and 15% from 2030 onward. For monetary transactions, VAT will be applied to the total consideration amount; for non-monetary transactions, the market value will be used. In transactions within larger arrangements, only the relevant portions will be taxable. In cases of related-party transactions or non-monetary exchanges, the market value determines the taxable amount.

Government agencies at all levels are tasked with collecting and remitting VAT as specified in the bill.

2. VAT Exemptions

Certain supplies are exempt from VAT under the proposed bill, including oil and gas exports, crude oil, feed gas, humanitarian project goods (with upfront VAT paid by donors), baby products, locally manufactured sanitary products, and military equipment. Additionally, electricity generated by GENCOs and supplied to the national grid or NBET, as well as electricity transmitted by TCN to DISCOs, are exempt from VAT.

3. 27.5% Company Tax Rate

Section 56 establishes a 27.5% tax rate on the profits of companies, with small firms taxed at 0%. From 2026, the tax rate for companies will be reduced to 25%. To address low effective tax rates, any company with an effective tax rate under 15% in a given year must pay additional tax to meet this threshold. This provision affects multinational groups and any company with a yearly turnover above N20 billion.

4. Development Levy on Companies

Section 59 introduces a development levy on the profits of companies, excluding small and non-resident companies. The levy rate will be 4% in 2025-2026, decreasing to 3% in 2027-2029, and further to 2% from 2030 onward. Proceeds from this levy will support the Student Education Loan Fund.

Revenue will be allocated as follows: The Tertiary Education Trust Fund will receive 50% in 2025-2026, 66% from 2027-2029, and zero from 2030 onward. The Student Education Loan Fund will receive 25% in 2025-2026, 33% from 2027-2029, and 100% starting in 2030. Meanwhile, the National Information Technology Development Fund will get 20% in 2025-2026 and zero from 2027 onward. The National Agency for Science and Engineering Infrastructure will receive 5% in 2025-2026, with zero from 2027 onward.

5. 5% Excise Tax on Lottery and Gaming Income

Section 62 and Schedule 10 of the bill impose a 5% excise tax on the revenue generated by lottery and gaming businesses. The law allows deductions for winnings, prize payments, Lottery Trust Fund contributions, agent commissions, and levies paid to federal or state authorities.

The bill defines “gaming” to include gambling, wagering, video poker, roulette, slot machines, and similar games of chance, while “lottery” covers betting, promotional competitions, and games based on skill or chance, as well as real or virtual sports outcomes.

6. 5% Telecoms Tax

The proposed bill also includes a 5% excise duty on telecommunications services, affecting both prepaid and postpaid services regulated by the Nigerian Communications Commission (NCC).

This landmark bill, if passed, would represent a major overhaul of Nigeria’s tax laws, with implications spanning various sectors and stakeholders.