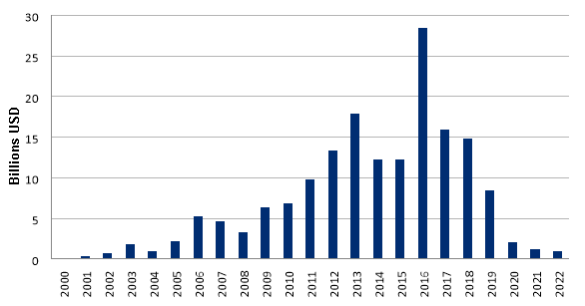

A new update to the Chinese Loans to Africa (CLA) Database, managed by the Boston University Global Development Policy Center, estimates that from 2000-2022, 39 Chinese lenders provided 1,243 loans amounting to $170.08 billion to 49 African governments and seven regional institutions.

For the years 2021 and 2022 combined, the CLA Database recorded a total of 16 new loan commitments worth $2.22 billion from Chinese lenders to African government borrowers, signifying two consecutive years of lending to Africa below $2 billion.

The CLA Database is an interactive data project tracking loan commitments from Chinese development finance institutions (DFIs), commercial banks, government entities and companies to African governments, state-owned enterprises and regional multilateral institutions.

A new policy brief analyzes the state of Chinese lending to Africa.

Main findings:

- Total loans: The CLA Database estimates that from 2000-2022, 39 Chinese lenders provided 1,243 loans amounting to $170.08 billion to 49 African governments and seven regional institutions.

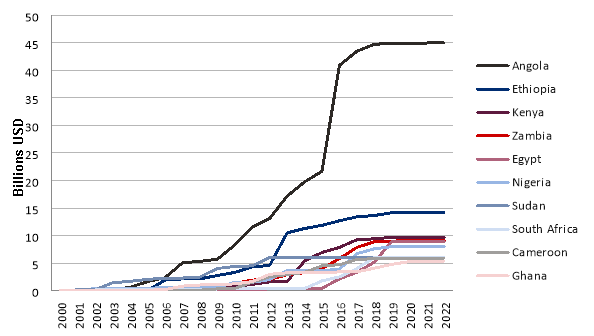

Figure 1: Chinese Loans to Africa, 2000-2022

Source: Chinese Loans to Africa (CLA) Database, 2023. Boston University Global Development Policy Center.

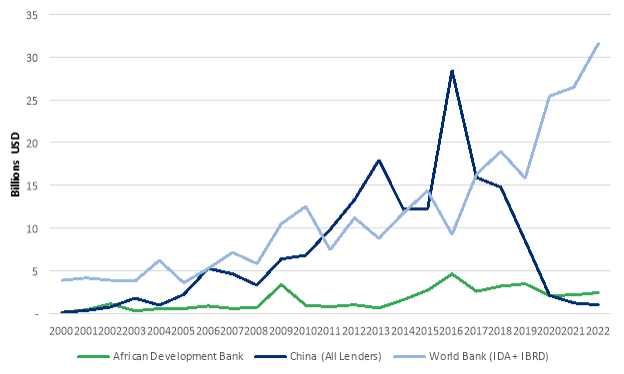

- Comparing loan totals to the World Bank and African Development Bank: At $170.08 billion, China’s estimated total lending from 2000-2022 is 64 percent of the World Bank’s $264.15 billion and almost five times the African Development Bank’s (AfDB) $36.85 billion in sovereign loans to Africa.

Figure 2: Comparison of Sovereign Loans to Africa from China, the World Bank and the African Development Bank

Source: Chinese Loans to Africa (CLA) Database, 2023. Boston University Global Development Policy Center. World Bank Group, Projects and Operations Database. African Development Bank Project Data Portal.

- New loans: For 2021 and 2022, the CLA Database recorded 16 new loan commitments worth $2.22 billion from Chinese lenders to African government borrowers, signifying two consecutive years of lending to Africa below $2 billion. In 2021, seven loans totaling $1.22 billion were signed, and in 2022, nine loans amounting to $994.48 million were signed.

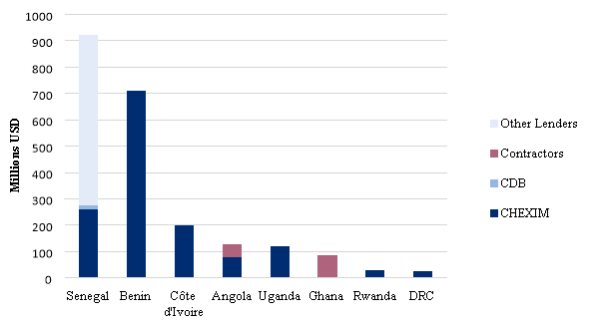

- Lenders: The Export-Import Bank of China (CHEXIM) continued to be the top lender in Africa, providing nine out of the 16 loans, amounting to $1.42 billion or 64 percent of all loans by amount in 2021-2022. The China Development Bank (CDB) provided no loans in 2021 but did extend a small $14.74 million loan in 2022 for a co-financed project. Other lenders include the Bank of China (BOC), China National Aero-Technology Import and Export Corporation (CATIC) and the China Shipbuilding Trading Company (CSTC).

Figure 3: Chinese Loans to Africa by Lender and Borrowers, 2021-2022

Source: Chinese Loans to Africa (CLA) Database, 2023. Boston University Global Development Policy Center.

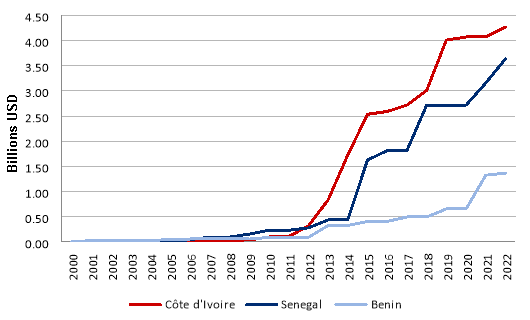

- Borrowers: Senegal, Benin, Cote d’Ivoire, Angola, Uganda, Ghana, Rwanda and the Democratic Republic of the Congo (DRC) were the borrowers in 2021-2022. This borrower composition is distinct from previous years, as West African countries like Senegal, Benin and Côte d’Ivoire borrowed a significant portion of loans by value for the first time.

Figure 4: Cumulative Chinese Loans to Senegal, Côte d’Ivoire and Benin, 2000-2022

Source: Chinese Loans to Africa (CLA) Database, 2023. Boston University Global Development Policy Center.

In contrast, loans to the historic top ten African borrowers from China remained relatively flat.

Figure 5: Chinese Loans to Top 10 African Country Borrowers, 2000-2022

Source: Chinese Loans to Africa (CLA) Database, 2023. Boston University Global Development Policy Center.

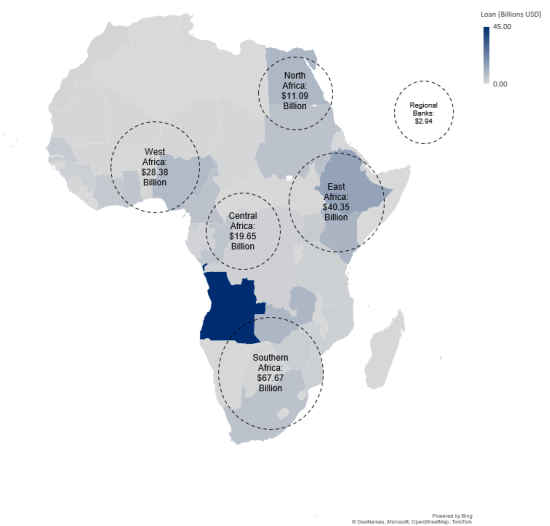

- Regional borrowing: From 2000-2022, countries in Southern Africa and East Africa have historically borrowed the most from China primarily due to large-scale loans in Angola, Zambia, South Africa, Ethiopia and Kenya. In 2021 and 2022, the regional composition is distinct from previous years; lending to West Africa was prominent while financing to North, Central, Southern and East Africa was minimal. West African countries who were not major borrowers in the past 20 years received a significant portion of loans.

Figure 6: Chinese Loans to Africa by Region, 2000-2022

Source: Chinese Loans to Africa (CLA) Database, 2023. Boston University Global Development Policy Center.

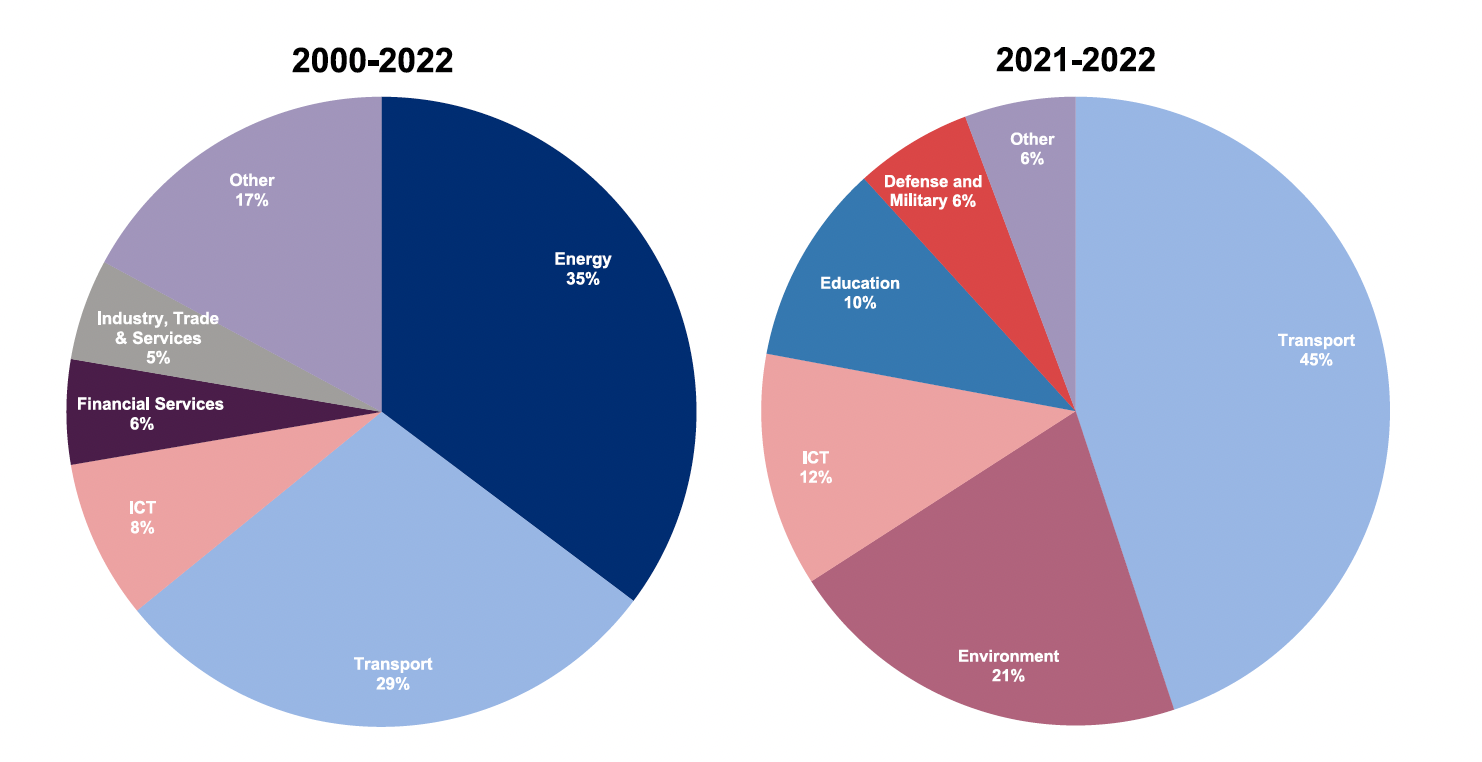

- Sectors: The sectors receiving finance in 2021-2022 were a mixture of traditional and nontraditional sectors. They included transport, environment, information and communications technology (ICT), education, defense and military, water/sanitation/waste, as well as industry, trade and services.

Figure 7: Comparison of Loan-receiving Sectors for Chinese Loans to Africa, 2000-2022 versus Chinese Loans to Africa, 2021-2022

Source: Chinese Loans to Africa (CLA) Database, 2023. Boston University Global Development Policy Center.

- No new energy projects: Although the African energy sector has historically received the most Chinese loans, the CLA Database identified no sovereign loans for energy projects in 2021 and 2022. Given the heavy fossil fuel composition of Chinese finance for energy projects in Africa and China’s commitments to greening the BRI, it is likely that what appears to be a hiatus from funding energy projects may just be a pause, as lenders scope out greener projects.

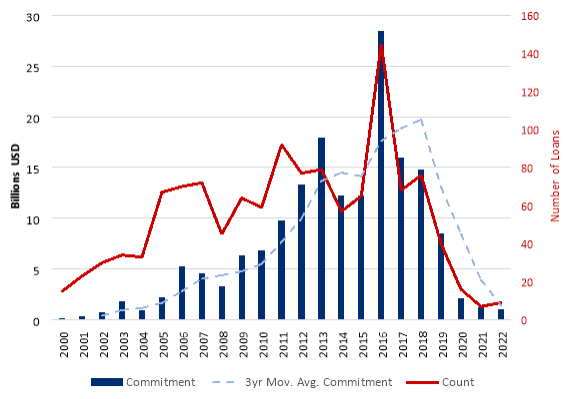

- Pre-pandemic to the present: Trends from the pandemic years (2020-2022) reveal a decrease in both the number and the value of loans. From the pre-pandemic years (2017-2019) to the pandemic years (2020-2022), loan averages dropped by 37 percent from $213.03 million to $135.15 million. This trend is more significant in terms of the number of loans, plummeting from 184 to 32 in the subsequent pandemic years.

Figure 8: Trend in Loan Amounts and Count for Chinese Loans to Africa, 2000-2022

Source: Chinese Loans to Africa (CLA) Database, 2023. Boston University Global Development Policy Center.

The bottom line: Through a combination of greening the Belt and Road Initiative (BRI), the China-Africa High-Quality Belt and Road Cooperation and the “small and/or beautiful” approach, future lending to Africa could mean less large-scale loans over $500 million, more loans with smaller values under $50 million and loans with more beneficial social and environmental impacts.

Important to note: CLA Database loan amounts are not equivalent to African government debt, as the database tracks commitments, and not disbursement, repayments or defaults.

Quotable:

- Oyintarelado Moses, Data Analyst and Database Manager – Global China Initiative, Boston University Global Development Policy Center: “Although levels of Chinese loans to Africa have declined in recent years, China’s overall lending to the continent has already served a purpose. Lending has contributed to development, expanded diplomatic exchanges and strengthened market integration between China and African countries. Given this established foundation in the China-Africa relationship, China will likely sustain engagement with the region through commercial and diplomatic channels, even if low lending levels persist.”

Dig deeper: